Renters Insurance in and around Sheboygan

Your renters insurance search is over, Sheboygan

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Your personal items and belongings have both sentimental and monetary value. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your TV to your video games. Wondering how much coverage you need? That's okay! Pete Fullerton wants to help you evaluate your risks and help pick the appropriate policy today.

Your renters insurance search is over, Sheboygan

Your belongings say p-lease and thank you to renters insurance

Why Renters In Sheboygan Choose State Farm

Renting is the smart choice for lots of people in Sheboygan. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance might cover smoke damage to the walls or a break-in that damages the door frame, who will repair or replace your belongings? Finding the right coverage helps your Sheboygan rental be a sweet place to be. State Farm has coverage options to match your specific needs. Thank goodness that you won’t have to figure that out alone. With personal attention and fantastic customer service, Agent Pete Fullerton can walk you through every step to help you helps you identify coverage that shields the rental you call home and everything you’ve invested in.

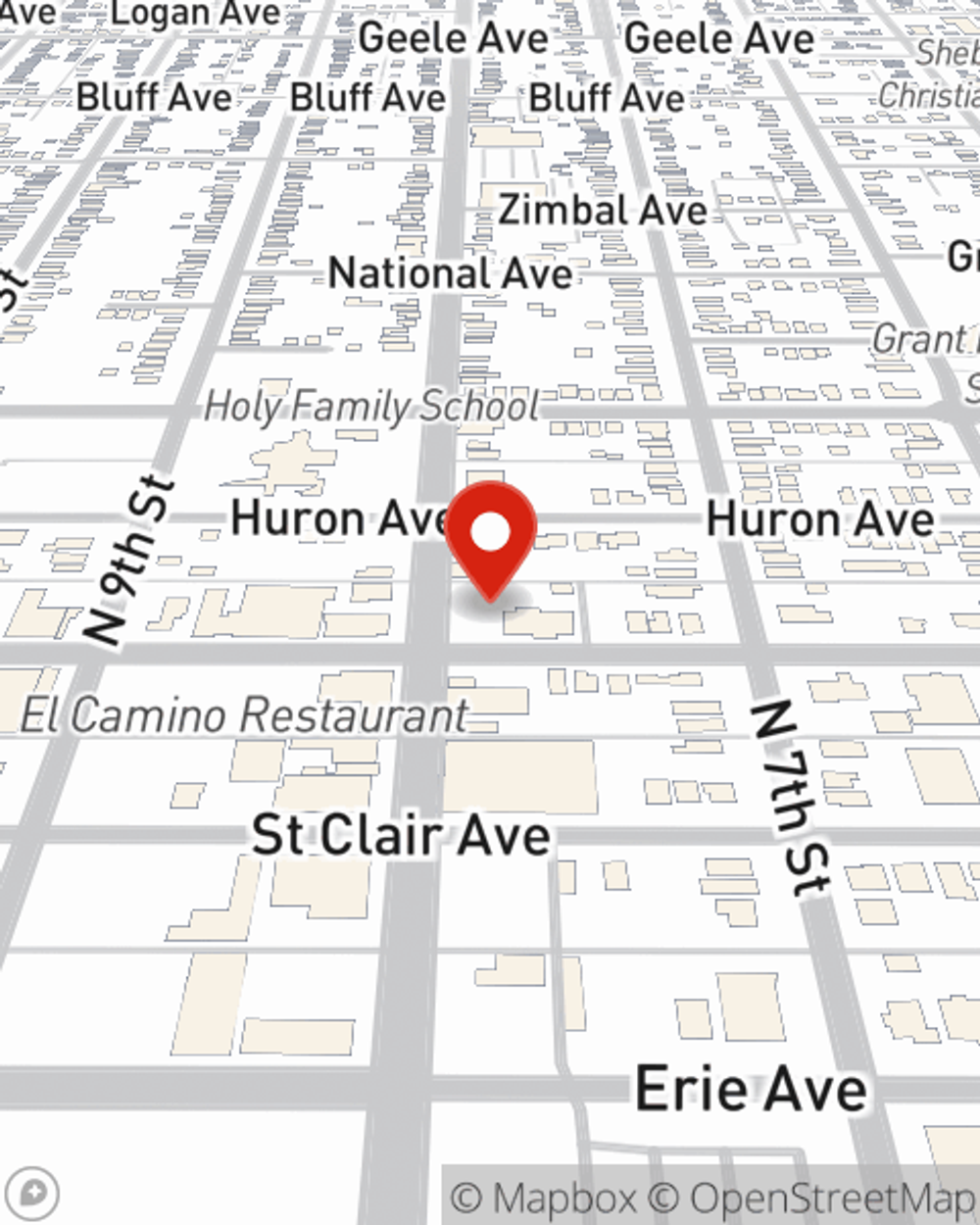

As one of the top providers of insurance, State Farm can offer you coverage for your renters insurance needs in Sheboygan. Visit agent Pete Fullerton's office for more information on a renters insurance policy that fits your needs.

Have More Questions About Renters Insurance?

Call Pete at (920) 458-4211 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

Pete Fullerton

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.